Brexit, the subsequent prospect of a ‘no deal’ Brexit and then the pandemic. These were all events that triggered prophecies of a fall in house prices. Yet, in that eight year period house prices in the UK have risen by an average of 67%.

Oops.

The property market and the spectre of its decline is an easy thing with which certain experts and financial institutions can grab a headline or two – and we know all about the merits of doing that. So fair play, I guess.

The problem is that with the spattering of recent, opportunistic ‘expert opinion’ (remember those same experts during Covid? Were they ever actually right?) comes a tendency for the media to crank the dial up even more versus what’s actually happening and this is why we have recently seen hysterical headlines such as ‘House Prices Will Fall 30% next year’ and so on.

I’m sometimes criticised for my optimism on the housing market even though I’ve so far been right on every call. My optimism comes from the reality that the UK housing market is incredibly resilient and from an understanding of (but not an expertise in) behavioral economics. In other words, the things that people actually do rather than what economists think people should do. If you’re interested in this stuff see the Freakonomics books and catch the podcasts. Buy.Ology is a great read too.

There are a number of things that we need to understand about the housing market and, firstly, is that it isn’t a see-saw. It is not black and white rather it is nuanced and provides multiple shades of grey in its manifestation. For a start, there is really no such thing as ‘the UK housing market’ nor an ‘average price’ because it’s a regionally divided thing with huge variations in values, growth and activity for a bunch of different micro reasons.

Ultimately, what prices do not do is to only go up or down in wild movements. It’s simply not a case of ‘if they aren’t increasing then they must be reducing’. Rather, there are gradients of growth and decline and, of course, flattening. Prices can stay still, obviously.

Simple secondary school economics tells us that for price changes to take effect there must be an imbalance in supply versus demand. If there are lots more buyers than sellers, prices go up just as we have seen in recent years. And if there’s a glut of sellers versus buyers, like 1990-1995 where sellers couldn’t afford their 15% mortgage rate, prices fall. If sellers do not need to sell and just stay put and this in turn reduces ‘stock’ to the same lower level as demand falls due to cautious buyers, then prices are unlikely to fall – let alone ‘crash’.

By the way, what is a crash? A 25% fall? A drop of 35%? 40%? Did you know that even in the depths of the 2008/9 financial crisis which threatened to destroy the global banking system and to herald a financial ice-age, UK house prices dropped by only 16% (Source). Even then there were still more than 800,000 annual transactions in those ‘wilderness years’ (Source). Because hundreds of thousands of people need to move each year.

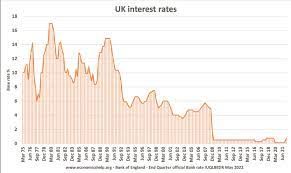

The 1990’s …. when we had home loan rates of 15%. That’s quite some reality check compared to the ‘heady’ rates today of a 3% Bank rate and mortgage rates of 5% or so, isn’t it? 5% is in fact normal, not high.

Is everyone affected by higher mortgage rates? Well no actually. The truth is that it’s a minority of homeowners that feel any squeeze. A bold statement perhaps, but one backed by actual evidence (we do love data here rather than just anecdotal whims). According to the Office of National Statistics, there are 15.6 owner occupied homes in England of which 8.8 million are owned outright. That’s 56% – the majority – that do not have a mortgage and are therefore not exposed to mortgage rate fluctuations. Of course, of the 6.8 million homes that are currently funded by a mortgage, the eminent UK Finance organisation tells us that 74% are on a fixed rate deal. That’s because almost all new mortgage borrowers choose a fixed rate deal at inception. The upshot? The majority of households are not affected by interest rate changes and this is a major factor in why the ‘Mortgage Costs Risk House Price Crash’ headlines are just plain wrong.

Inflation is the cause of the Bank of England’s quest to pull our belts in by raising their borrowing rate, now at 3% from 0.1% earlier this year. This, to attempt to reach the Bank’s mandate of a 2% inflation level. I was on a panel at the National Landlord Investment Show recently with legendary journalist Andrew Neil and Sunday Times Business Editor David Smith and they were explaining that wholesale gas prices today are just 30% of what they were in August. Oil prices are at about the same level today as they were in January – before the Russian invasion of Ukraine – down 28% on the high of 8th March this year.

So, energy prices have reduced and inflation will benefit. And there will be less pressure on Bank borrowing rates accordingly, plus Gilt yields and Swap rates have reduced considerably anyway. Money is getting cheaper despite what you may otherwise read in the press as written by over zealous journos.

And have you heard the one about not enough houses being built? It’s no joke, it’s been that way since the MacMillan government of the 1950’s when over 300,000 homes were built. We’ve not built anything like that number since then despite the population of Britain now being bigger in 2022 to the tune of 16m more people. Add to this the fact that we are living longer and that around 20% of homes are single occupier and we begin to realise the true and significant extent of the demand versus supply imbalance. Simply, there aren’t enough homes to buy or to rent and this keeps prices buoyant.

Then there’s culture in that we are an aspirationally home owning culture – ‘Safe as houses’ isn’t a well-worn saying for nothing.

During October and November I have been at pains to articulate on national TV and radio why house prices will not crash and have also talked about one other factor that’s evident under our new PM in Rishi Sunak.

During the perils of the Covid pandemic and repeated lockdowns, what did he do in addition to introducing the furlough scheme? He bolstered the housing market by a) keeping estate agents and house builders open for business whilst every other business was restricted and b) by removing stamp duty for all property buyers including second steppers, investors and overseas buyers up to a £500,000 purchase price, saving up to £15,000 each and thus igniting a fire under the housing market. Why? Because Rishi understands that the wider economy is fuelled by sentiment, and the property market is key to positive sentiment. If you want the former, you have to buoy the latter.

And my belief is that if need be, he’ll do the same or similar again.

On the subject of stamp duty, don’t forget that FTBs now pay a zero rate on purchases up to £300,000 and then only on the proportion between £300,000 and £600,000 on purchases up to £600,000. Most First time purchasers pay no stamp duty at all now. And the rest of us have just benefited from a threshold hike to £250,000 – a doubling of the floor level at which the tax kicks in. Another obstacle removed.

Journalists are awesome people and work tirelessly. But do their editors sometimes encourage the sensationalisation of a story for the sake of grabbing more eyeballs, clicks, comments and above all, ad revenue? You bet they do.

Rest easy. Are we in for a less frantic market? Yes. Will prices continue to increase by double digits each year? No, thankfully.

Will we see a ‘crash’ in property prices? Well talking of bets, I’ll take ANY bet that we won’t.

Bring on 2023 – a year of normality.

Author: Russell Quirk, Co-Founder of ProperPR and regular property market commentator for BBC, TalkTV, LBC, GB News, Reuters…